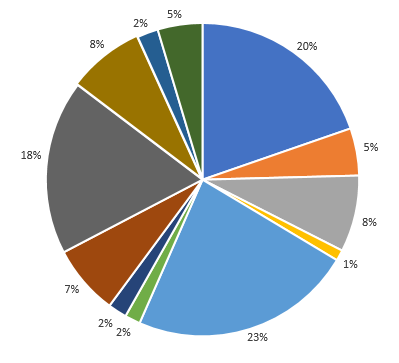

So what are our results in settlement volumes for residential mortgages:

- Loans “brokered” over 12 separate lenders

- no one lender more than 23%

- Big 4 banks combined 47%

And, how does this compare to the market?:

- Big 4 banks combined 79%

- CBA 25%, Westpac 24%, ANZ 15%, NAB 15%

- Source: ACCC Residential Mortgage Pricing Inquiry Interim Report

Clients generally engage a broker to achieve one of three solutions:

- experienced and professional advice: eg self employed, or new resident without credit history, or multiple investment property portfolio (complex)

- convenience: eg a busy professional or family seeking a quick and easy loan approval aligned with their best interests (efficient)

- compare the market: eg a first home buyer needing their first mortgage at a low interest rate (comparison)

Brokers not only bring competition into a market dominated by some of Australia’s biggest companies, more importantly we offer advice tailored specifically to our client’s best interests and their individual requirements. Most people will have a mortgage for 30 years, and it is very re-assuring to have a professional broker work with you, on your team, over the long term.

The Loan Broker continues to operate a model of no fees charged to clients: we are paid an upfront and a trailing commission from the banks to service new and ongoing loan clients and see this as a very effective model to bring competition to the banking market as well as at the same time placing our clients at the very center of every decision and all lending advice.

Latest News

QUESTIONS WHEN CHOOSING A BROKER?March 6, 2023 - 1:33 pm

QUESTIONS WHEN CHOOSING A BROKER?March 6, 2023 - 1:33 pm A POINT-BANK EXPLANATION: BROKER VS BIG BANK FOR YOUR FINANCE CHOICESMay 22, 2020 - 12:23 am

A POINT-BANK EXPLANATION: BROKER VS BIG BANK FOR YOUR FINANCE CHOICESMay 22, 2020 - 12:23 am A MORTGAGE BROKERS STATISTICS – WHICH BANK?July 22, 2019 - 12:16 am

A MORTGAGE BROKERS STATISTICS – WHICH BANK?July 22, 2019 - 12:16 am HOW DO LENDERS WORK OUT WHETHER YOU CAN AFFORD A LOAN?August 31, 2018 - 3:06 am

HOW DO LENDERS WORK OUT WHETHER YOU CAN AFFORD A LOAN?August 31, 2018 - 3:06 am HOUSING OUTLOOKAugust 22, 2017 - 12:26 am

HOUSING OUTLOOKAugust 22, 2017 - 12:26 am

Quick Links

Contact

Phone: 07 3904 7186

Email: loans@theloanbroker.com.au