But what to check:

- Are they 100% independent?

- Are they experienced?

- Are they successful themselves in the field you are seeking to engage them in?

- Is there a “fit” between what you want/who you are, and what they will deliver/who they are… it is always more enjoyable and easier to work with someone “on your wavelength”.

- Will there be the opportunity for a long-term relationship that you can “grow old with”?

- Do they place your interests above all else?

- Do they protect your privacy at all times?

- Are they transparent?

- Are they accountable?

These questions are relevant for any professional you seek to work with in all financial services and property services…. Accountants, Wealth Advisors, Real Estate Agents, Solicitors, Property Managers.

To answer some of the checklist above for myself:

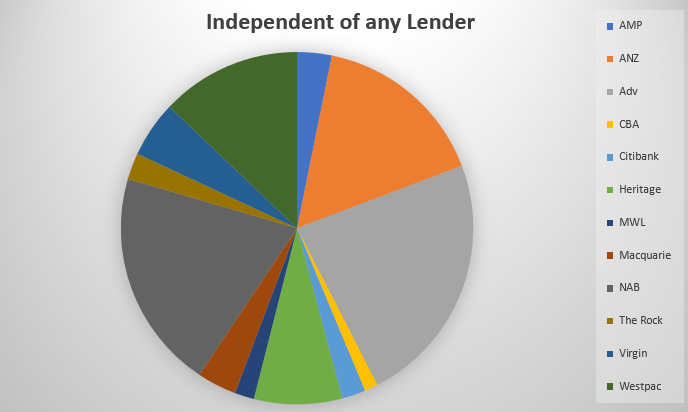

- We are 100% independent of any bank or lender

- As a guiding principal we never pay or receive commissions from any party other than the lender or insurer you choose… I have never paid or received any referral payment to or from another professional (accountant, real estate agent, financial planner, etc)

- I have 20+ years experience as a CPA accountant, in banking and small business, and deep experience in property, and am helped by a very capable support team

- For transparency, and to reinforce that we place the clients interest first every time, the graph is my spread of lenders from the past 9 months

Do some homework, pick up the phone, explain what you seek and ask for their “cred”… and then go with your gut instinct.

Latest News

QUESTIONS WHEN CHOOSING A BROKER?March 6, 2023 - 1:33 pm

QUESTIONS WHEN CHOOSING A BROKER?March 6, 2023 - 1:33 pm A POINT-BANK EXPLANATION: BROKER VS BIG BANK FOR YOUR FINANCE CHOICESMay 22, 2020 - 12:23 am

A POINT-BANK EXPLANATION: BROKER VS BIG BANK FOR YOUR FINANCE CHOICESMay 22, 2020 - 12:23 am A MORTGAGE BROKERS STATISTICS – WHICH BANK?July 22, 2019 - 12:16 am

A MORTGAGE BROKERS STATISTICS – WHICH BANK?July 22, 2019 - 12:16 am HOW DO LENDERS WORK OUT WHETHER YOU CAN AFFORD A LOAN?August 31, 2018 - 3:06 am

HOW DO LENDERS WORK OUT WHETHER YOU CAN AFFORD A LOAN?August 31, 2018 - 3:06 am HOUSING OUTLOOKAugust 22, 2017 - 12:26 am

HOUSING OUTLOOKAugust 22, 2017 - 12:26 am

Quick Links

Contact

Phone: 07 3904 7186

Email: loans@theloanbroker.com.au